Fonds im Fokus

Carmignac Sécurité: the Fund Manager’s thought

The monetary and fiscal policies that took shape during the second quarter fully delivered their effects on financial markets in the third.

The assurance that the ECB would unfailingly buy financial assets, combined with the European Union’s pledge to cover part of member states’ financing needs as of 2021, was enough to keep German bond yields steady during the quarter. 5- and 10-year Bunds traded within a 15-basis-point range and ended the quarter practically where they had started, which was –0.50% in the case of 10-year paper. This stability at markedly negative yields was what convinced us to hold no substantial positions in that market segment over the period.

A different picture emerges, however, when you consider other eurozone countries, particularly those offering significant credit spreads at a time of negative interest rates – i.e., Italy, Greece, Portugal, Cyprus and Spain. Bond yields in those countries fell consistently throughout the summer. Those on Italian 10-year issues shrank from 1.3% to almost 0.7%. In response, we at Carmignac Sécurité stayed highly active in this corner of the fixed-income market, beefing up our holdings of sovereigns from Southern Europe and extending the maturities on them to between 5 and 7 years. After the summer rally, we scaled back those positions, notably by selling off the shortest-maturity bonds paying negative yields. At the end of September, Italian sovereign and quasi-sovereign debt accounted for the bulk of our government bond portfolio.

The other big winner in this policy mix has been corporate credit

Despite the unprecedented economic slump, companies managed from early April onwards to secure the funding they needed via primary issues. Our Fund invested extensively in them to access the relatively high yields on offer. Once the worst was over, the low overall level of so-called risk-free rates, combined with central-bank support through asset purchases, made it possible for corporate credit to book solid performance.

-

-

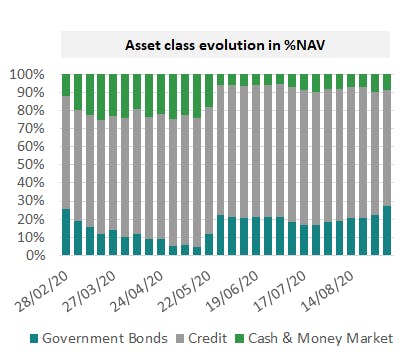

Credit spreads narrowed sharply in July and August, though September was more of a mixed bag. Ever since April, we have been steadily raising our exposure to this kind of debt to a high point at which it accounted for 67% of our total portfolio (not including investments in CLOs). That point was reached at end-July, with that allocation accounting for almost two thirds of the Fund’s total modified duration. From then on, we gradually reduced duration, and more markedly so in late August.

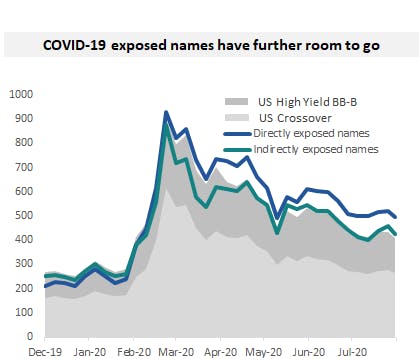

We mainly sold the longest maturities in our portfolio on negative-yielding bonds, as well as on issues that didn’t enjoy direct ECB support (chiefly bank bonds and bonds from non-eurozone issuers). At the same time, we have maintained our strong convictions on companies directly affected by the economic and public health crisis despite having extremely healthy balance sheets, which give them the cushioning needed to weather the storm. Names that come to mind include Easyjet and Airbus in aviation, the Carnival cruise line and Pemex in the energy sector.

-

At end-September, corporate credit accounted for 56% of the Fund’s assets. We made no change to our CLO allocation in the quarter. That asset class has one of the most attractive risk/return profiles in the euro market (particularly on the highest-rated CLOs), which is why we have kept our exposure at around 7.5% of our portfolio. -

In the last quarter of 2020, we will be in for a number of developments that stand a good chance of surprising the market. The US presidential election, Brexit and a possible vaccine all have the potential to make financial asset prices more volatile. By reducing portfolio risk while holding onto several strong convictions, we at Carmignac Sécurité should have the agility required in such an environment.

Carmignac Sécurité AW EUR Acc

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

2025 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Sécurité AW EUR Acc | +1.12 % | +2.07 % | +0.04 % | -3.00 % | +3.57 % | +2.05 % | +0.22 % | -4.75 % | +4.06 % | +5.28 % | - |

| Referenzindikator | +0.72 % | +0.30 % | -0.39 % | -0.29 % | +0.07 % | -0.15 % | -0.71 % | -4.82 % | +3.40 % | +3.16 % | - |

Srollen Sie nach rechts, um die ganze Tabelle zu sehen

| 3 Jahre | 5 Jahre | 10 Jahre | |

|---|---|---|---|

| Carmignac Sécurité AW EUR Acc | +1.43 % | +1.31 % | +1.02 % |

| Referenzindikator | +0.51 % | +0.13 % | +0.11 % |

Srollen Sie nach rechts, um die ganze Tabelle zu sehen

Quelle: Carmignac am 31/12/2024

| Einstiegskosten : | 1,00% des Betrags, den Sie beim Einstieg in diese Anlage zahlen. Dies ist der Höchstbetrag, der Ihnen berechnet wird. Carmignac Gestion erhebt keine Eintrittsgebühr. Die Person, die Ihnen das Produkt verkauft, teilt Ihnen die tatsächliche Gebühr mit. |

| Ausstiegskosten : | Wir berechnen keine Ausstiegsgebühr für dieses Produkt. |

| Verwaltungsgebühren und sonstige Verwaltungs- oder Betriebskosten : | 1,11% des Werts Ihrer Anlage pro Jahr. Hierbei handelt es sich um eine Schätzung auf der Grundlage der tatsächlichen Kosten des letzten Jahres. |

| Erfolgsgebühren : | Für dieses Produkt wird keine erfolgsabhängige Provision berechnet. |

| Transaktionskosten : | 0,14% des Werts Ihrer Anlage pro Jahr. Hierbei handelt es sich um eine Schätzung der Kosten, die anfallen, wenn wir die Basiswerte für das Produkt kaufen oder verkaufen. Der tatsächliche Betrag hängt davon ab, wie viel wir kaufen und verkaufen. |

* Keith Ney arrival (22/01/2013). Performance Indicator: EuroMTS 1-3 years index (EUR). Performance of the A EUR acc share class. Past performance is not necessarily indicative of future performance. The return may increase or decrease as a result of currency fluctuations. Performances are net of fees (excluding possible entrance fees charged by the distributor).

Carmignac Sécurité AW EUR Ydis

Empfohlene Mindestanlagedauer

Geringstes Risiko Höchstes Risiko

ZINSRISIKO: Das Zinsrisiko führt bei einer Veränderung der Zinssätze zu einem Rückgang des Nettoinventarwerts.

KREDITRISIKO: Das Kreditrisiko besteht in der Gefahr, dass der Emittent seinen Verpflichtungen nicht nachkommt.

KAPITALVERLUSTRISIKO: Das Portfolio besitzt weder eine Garantie noch einen Schutz des investierten Kapitals. Der Kapitalverlust tritt ein, wenn ein Anteil zu einem Preis verkauft wird, der unter seinem Kaufpreis liegt.

WÄHRUNGSRISIKO: Das Währungsrisiko ist mit dem Engagement in einer Währung verbunden, die nicht die Bewertungswährung des Fonds ist.

Der Fonds ist mit einem Kapitalverlustrisiko verbunden.